Similar Posts

Processing Auto Super in Xero

You have setup the Auto Super feed in Xero and now you are ready to run your first Super lodgement. Follow these simple steps and you will be processing Super within a couple of clicks. Processing Auto Super from Xero…

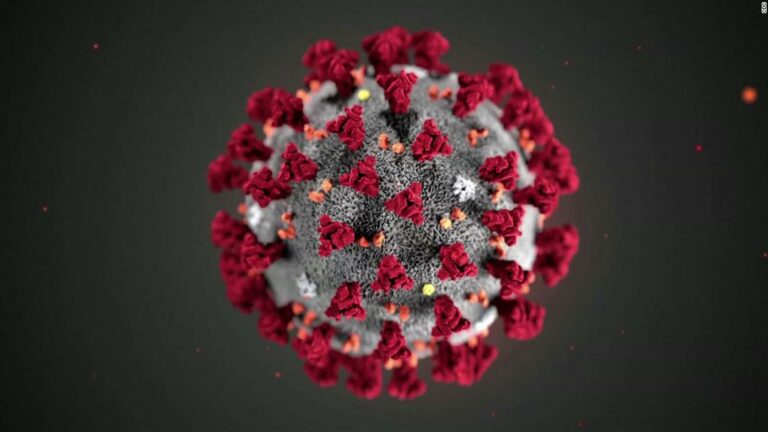

Cash Flow Boost For Employers PAYGW Stimulus

PAYGW Stimulus Package Cash Flow Boost for Employers Unravelling the stimulus package for PAYGW rebates for those small businesses with staff, NFP and the Business Boost Payment of $50,000 #COVID19PAYGW Stimulus breakdown If you have any questions in relation to…

Quickbooks Online Workshops Commencing for 2020

Quickbooks Online has one of the best mobile devices on the accounting software market. From the ease of your phone you can create a quote, send and invoice, upload your expense receipts, track mileage and even run your profit and…

#Melbourne #Training #FNS40215

Class room training for the Certificate IV Financial Services for Bookkeepers FNS40215 using Xero commences on the 27/11/17 in Melbourne. This course runs over 2 weeks back to back. Details of the venue will be announced shortly. To register please…

Manual Systems are a cause of stress that are easily replaced

All a manual system does is create stress as the first thing the business owner thinks of is finding the time to do what needs to be done before the compliance part of the business even begins. Stress about when,…

JobKeeper Payment Coronavirus Business Stimulus #3

JobKeeper Package If you have any questions in relation to the following information do not hesitate to contact our office via email info@basandbalances.com.au and one of our friendly BAS Agents will be able to assist you with your individual enquiry….