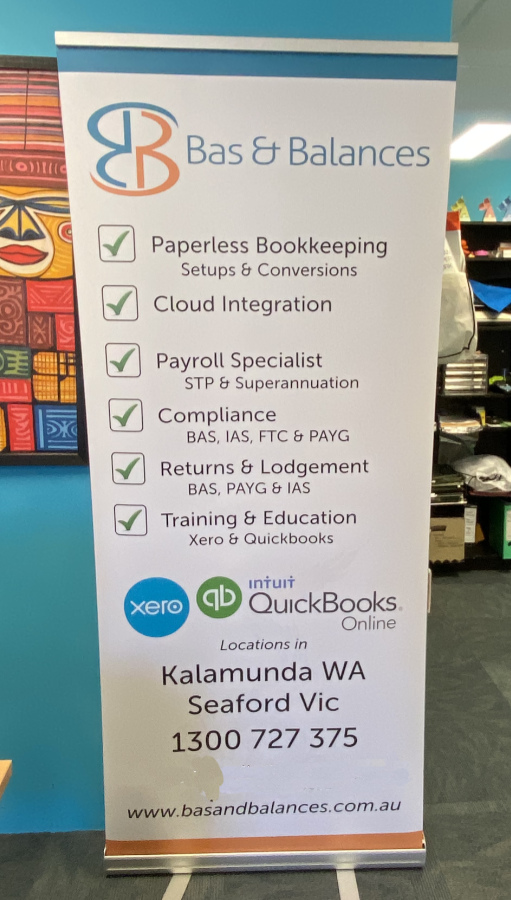

Payroll & Superannuation Compliance

Payroll, PAYG, and superannuation are all essential aspects of running a business in Australia. If you don’t comply with the relevant regulations, you could face serious financial penalties. That’s where we come in.

We offer a comprehensive range of payroll and PAYG and superannuation compliance services, including:

- Payroll processing

- PAYG tax calculation and remittance

- Superannuation contributions

- BAS reporting

We are a team of experienced and qualified bookkeepers who are experts in payroll, PAYG, and superannuation compliance. We understand the complex regulations that businesses must adhere to, and we are committed to providing you with accurate and compliant services.

We are also reliable and trustworthy. We have a reputation for providing excellent customer service, and we are always available to answer your questions and address your concerns.

To learn more about our payroll and PAYG and superannuation compliance services, please contact us today. We would be happy to discuss your needs and see how we can help you.

Benefits of Working with Us:

- Peace of mind knowing that your payroll and PAYG and superannuation are compliant

- Time saved so you can focus on running your business

- Reduced risk of financial penalties

- Increased accuracy and efficiency

- Improved cash flow management

To learn more about our payroll and PAYG and superannuation compliance services, please contact us today. We would be happy to discuss your needs and see how we can help you.